Uniting Financial Services (UFS) has joined the Clean Energy Finance Corporation (CEFC) to drive Australia’s commercial property sector towards a higher-performance future.

UFS is the Treasury and Investment Services arm of the Uniting Church in Australia Synod of NSW and the ACT.

UFS has committed $25 million to the High Income Sustainable Office Trust (HISOT). The CEFC has already made a cornerstone $125 million equity commitment to HISOT. Leading real estate fund manager, EG Funds Management (EG) is the HISOT manager and is targeting a $400 million portfolio.

The HISOT is designed to refurbish up to a dozen decentralised city office buildings, giving them a new lease on life through improvements that increase their sustainability and reduce their carbon emissions.

CEFC Corporate and Project Finance Director, Rory Lonergan, said the CEFC’s commitment to HISOT reflected the CEFC’s broader strategy to drive Australia’s commercial property sector towards carbon neutral buildings.

“For our cities to be competitive and dynamic business centres in the future, it is imperative that we act now to boost the energy performance of buildings so they are equipped to handle the demands of a clean energy economy,” Mr Lonergan said.

“High cost CBD office spaces, infrastructure constraints and urban regeneration are all major factors contributing to increased demand for higher performing commercial office space in outer metropolitan areas. The decentralisation of government departments is also driving up demand.

“Through the HISOT we’re looking to develop and refurbish buildings in these outer areas so that they have increased performance and lower carbon emissions. Energy efficient buildings have lower operating costs and have the potential to provide higher net operating income and have lower vacancy rates, providing clear benefits to building owners, investors and tenants.”

UFS is the first institutional investor to support HISOT, alongside the CEFC and EG. As HISOT grows it will purchase eligible buildings and reposition them. In broad terms, the HISOT intends to improve the energy efficiency of properties to the equivalent of at least 4.5 stars under the National Australian Built Environment Rating System (NABERS).

Warren Bird, UFS Executive Director Treasury and Investments said UFS invests according to the Uniting Church’s ethical investment policies and recognises the ongoing environmental and social benefits of revitalising decentralised city office buildings.

“The Uniting Church Synod of NSW and the ACT is one of the earliest adopters of ethical investment principles. We are deeply passionate about investment opportunities that have positive environmental and social benefits and meet our rigorous Ethical/ESG investment due diligence process,” Mr Bird said.

A positive step forward

Over the last couple of years, UFS has been actively seeking investments that implement the Church’s ethical investment principles in a positive way, rather than simply avoiding assets that are excluded.

The latest and very exciting step in that direction is to partner with the Clean Energy Finance Corporation as the seed investors in a unique fund that will enhance the energy efficiency of the properties that it acquires. The fund will be managed by EG Funds Management, who bring to the table significant strengths in property research and asset management.

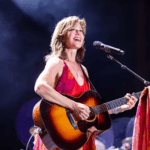

(Pictured) Warren Bird, Executive Director of Uniting Financial Services