Understanding your organisation’s level of comfort with risk and reviewing this regularly is a critical part of the investing process.

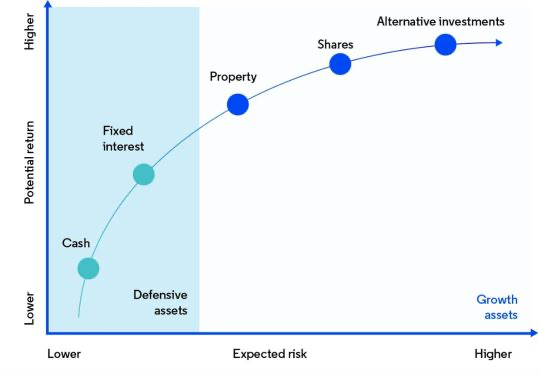

When it comes to investing, risk and reward go hand in hand. This is because investments that offer a higher return generally come with higher volatility and risk of capital loss, particularly in the short-term.

For investors, an important starting point in determining how to invest is to understand their risk tolerance, which is the level of risk they are prepared to accept in order to generate a return. This then helps to determine the type and balance of investments to choose.

Greater risk tolerance is often synonymous with investment in stocks, property and alternative investments such as infrastructure, while lower risk tolerance is often associated with the purchase of fixed income assets such as bonds, and cash or cash-like investments.

The chart below shows the risk and return profiles of each of the different asset classes.

Source: MoneySmart

How to manage investment risk

1. Diversify

When selecting an asset allocation, one way to manage risk is to diversify investments across different asset classes. The benefit of this is that different asset classes perform well at different times in the market cycle. If a portfolio contains one or two asset classes that are performing poorly at a given time, there may be other asset classes that are performing better and helping to balance out any losses.

It is also important that an investment portfolio is diversified within, as well as across, all asset classes. This means spreading risk by investing in a range of companies or assets across different sectors to lower the potential for volatility in returns when one company underperforms.

2. Consider the timeframe

The investment timeframe also has a significant impact on investment decisions and the risk an investor is prepared to take.

For example, an investor with a short-term financial goal, such as saving for a property purchase, paying for Church repairs or paying salaries, may wish to invest in low-risk assets such as cash or fixed-term investments to preserve capital.

A second investor who has a long-term investment horizon, and therefore has time to ride out the market ups and downs, may consider investing in higher risk assets such as stocks, property and infrastructure in order to maximise their returns.

3. Revisit the investment strategy

Finally, investors should review their investment strategy regularly to ensure it is still appropriate for their needs. If circumstances have changed, the plan can be updated accordingly.

Get the right advice

If your organisation is looking to review its investment strategy, help is available. Uniting Financial Services (UFS) offers a range of investment solutions which have been designed with Church entities in mind and can work with organisations to understand their unique investment goals.

To get in touch email UFS at contactus@unitingfinancial.com.au

Important information: The Uniting Financial Services (UFS) unregistered managed investment schemes are available for investment only to wholesale investors. Prospective wholesale investors who wish to invest via our unregistered managed investment schemes can access the Information Memoranda for these any of these funds on the UFS website. While the information in this email has been prepared with all reasonable care, UFS accepts no responsibility or liability for any errors, omissions or misstatements however caused. No action has been taken to register or qualify these products or otherwise permit a public offering of these products in any jurisdiction outside Australia. Past performance is not indicative of future performance.

Edwin Lo

Chief Investment Officer, Uniting Financial Services