UnitingCare Australia’s National Director, Lin Hatfield Dodds, said today most Australians would be surprised to learn the tax system provides more support and concessions to high income households than to Australians living below the poverty line.

In a discussion paper — What Price Dignity — released today, retirement incomes are examined as one example of the inequities which plague the tax system.

“Australian taxpayers contribute a massive $27 billion a year in tax concessions to help some of the wealthiest Australians accumulate hefty retirement savings,” Ms Hatfield Dodds said.

“Income drawn from these savings is tax exempt and the same people are provided with access to the concessions designed to help low income earners meet basic costs such as utilities, transport and health care.

“Wealthy Australians receive generous health concessions and an annual, tax free payment of $800 a year to help them with the cost of water and electricity. This payment is being made to people with millions of dollars in accrued superannuation who live on tax free incomes of over $100,000 a year.

“Australians should be encouraged to save for their retirement. But assistance must be targeted to low income earners to pursue the same goal. Existing concessions should be targeted to the people who need them most.

“The Australian Treasury estimates that more than a third of the benefits of superannuation tax concessions, around $10 billion, accrue to the top five per cent of income earners.

“It is a shocking waste that more than $10 billion of public money is spent helping a privileged minority to enjoy a lifestyle beyond the reach of most.

“Meanwhile many older Australians, including those whose caring responsibilities have excluded them from accumulating savings, struggle to meet their most basic costs in retirement.

“This is just one illustration of why we need to check and tune-up the tax system.

“It used to be that people with similar incomes should pay similar amounts of tax, and that people who earn more should pay proportionately more tax. But the provision of tax concessions to superannuation and the decision to exempt income from superannuation from income tax dramatically violates both of these principles.

“Tax concessions that provide generous support to already wealthy Australians are unfair and unjustified, and demonstrate the need for reform so that taxpayer funds are directed where they are needed most,” Ms Hatfield Dodds said.

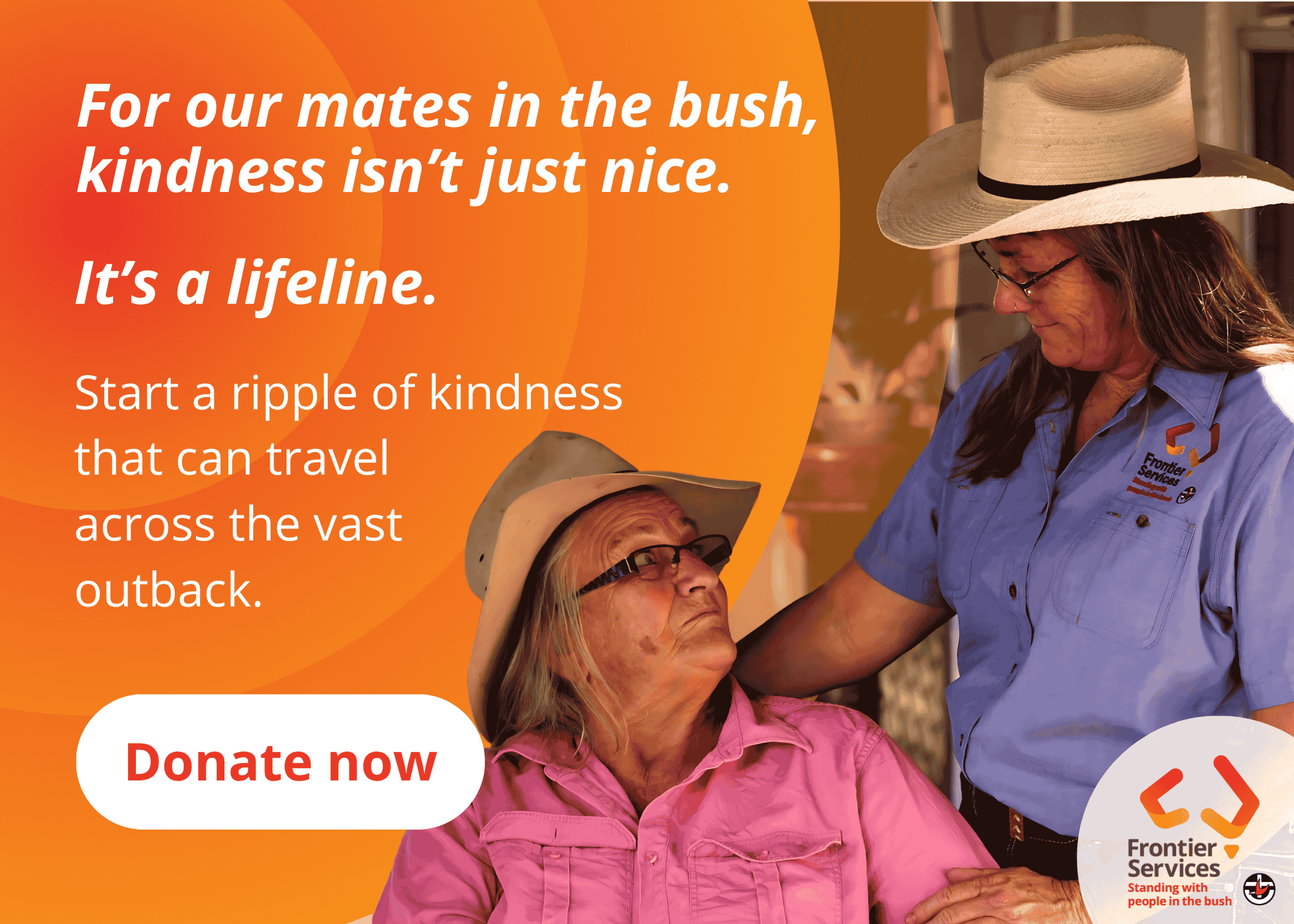

The UnitingCare network provides social services to over 2 million people each year in 1,300 sites in remote, rural and metropolitan Australia. UnitingCare has 35,000 staff and 24,000 volunteers.