Schofield Loans: building more sustainable churches

Is your church suffering from a leaky roof, worn-out windows or a crumbling façade? Do you need to upgrade a kitchen or bathroom in your church or manse? Is your Church’s technology in need of an upgrade? Is your organisation’s energy bill burning through much-needed funding? If so, you may be able to benefit from a Schofield Loan.

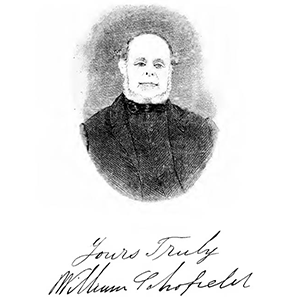

Established in 1898, Schofield Loans were created following a bequest from the late Rev. William Schofield, who died in 1878 and left a sum of £22,000 in his will to be employed as a perpetual loan fund for churches.

Rev. Schofield, originally from Yorkshire, England, took a six-month voyage to Australia in 1814, becoming a minister for the New South Wales and Queensland Conference of the Australian Wesleyan Methodist Church. During his years of service Rev. Schofield acted as a chaplain in Tasmania, Sydney and Melbourne.

Rev. Schofield, originally from Yorkshire, England, took a six-month voyage to Australia in 1814, becoming a minister for the New South Wales and Queensland Conference of the Australian Wesleyan Methodist Church. During his years of service Rev. Schofield acted as a chaplain in Tasmania, Sydney and Melbourne.

After making provision for his immediate relatives, Rev. Schofield left the whole of his property – worth £22,000 – to the church. Further benefactions were added in 1993 when proceeds from the former Presbyterian Church were incorporated. More than 140 years after Rev. Schofield’s passing, congregations within the Uniting Church are still benefiting from funding due to his generous bequest.

How can a Schofield Loan help?

A Schofield Loan is a low-interest loan available to Uniting Church organisations for repairs to church buildings and manse properties and for installing solar power.

The funds and associated borrowing will assist congregations in the work with the Synod’s Future Directions strategy.

Your organisation can apply for a loan of up to $50,000 for repairs to church buildings, $25,000 for repairs to manse properties or $15,000 for installing solar power to help cut your energy bills and improve the sustainability of your building. All loans are subject to Synod approval.

Should your organisation wish to borrow more than the amounts on offer, UFS can also discuss whether we can assist with an additional loan at a reduced rate to help you carry out planned repair works.

More information on the terms and conditions of Schofield Loans can be found on the Uniting Financial Services website, or you can contact the UFS Partner Solutions and Support team on 1300 133 673 or via email at contactus@unitingfinancial.com.au.

Making the most of rebates

For solar installations, your organisation may be eligible for a government rebate and may also receive payment for any excess energy that is fed back to the grid within the National Energy Market. Tariffs vary by state. Find out more at energy.gov.au

Leaving a lasting legacy

If you are interested in leaving a bequest to the Uniting Church in your estate plan to help our Church organisations as Rev Schofield did, more information can be found here.

Important information: Financial services are provided by The Uniting Church (NSW) Trust Association Limited ACN 000 022 480, ABN 89 725 654 978, AFSL 292186 and by The Uniting Church in Australia Property Trust (NSW) ABN 77 005 284 605 pursuant to a s.911A Corporations Act 2001 (Cth.) authorisation and APRA Banking Exemption No.1 of 2021 (“Uniting Financial Services”), for The Uniting Church in Australia, Synod of NSW and the ACT and ASIC Regulatory Guide 87 and ASIC Corporations (Charitable Investment Fundraising) Instrument 2016/813 exemptions.

Uniting Financial Services® is a registered trademark of The Uniting Church (NSW) Trust Association Limited and is used with permission by The Uniting Church in Australia Property Trust (NSW). Neither The Uniting Church in Australia, Synod of NSW and the ACT, The Uniting Church in Australia Property Trust (NSW) nor Uniting Financial Services is prudentially supervised by APRA. An investment or contributions will not benefit from the depositor protection provisions of the Banking Act 1959 (Cth.).

All financial services and products are designed for investors who wish to promote religious and charitable purposes and for whom profit considerations are not of primary importance in their decision to invest. Conditions, fees and charges apply. These may change or we may introduce new ones in the future. Full details are available on request. This information does not take your personal objectives, circumstances or needs into account. Consider its appropriateness to these factors before acting on it. We recommend you refer to the Product Disclosure Statement, the Product Information Brochure and the Financial Services Guide for Terms and Conditions before deciding. Unless otherwise specified, the products and services described are available only in Australia.

While the information in this communication has been prepared with all reasonable care, UFS accepts no responsibility or liability for any errors, omissions or misstatements however caused. No action has been taken to register or qualify these products or otherwise permit a public offering of these products in any jurisdiction outside Australia. Past performance is not indicative of future performance. - Tags: church repairs, future directions, loans