I started doing a clean-up of some cupboards in my office at UFS recently. Mostly there were old documents that could be simply tossed, but among them I found some that need to be kept for their historical significance. One of these documents is 10 pages that are going brown from age, but which read as freshly as if they’d been typed yesterday.

This particular document is a report from the Victorian Synod in 1980, which references a resolution from the first Synod meeting in 1977, on the subject of ethical principles for the Church’s “commercial investments”. That resolution had called for guidelines to be drawn up that would “ensure that the investment policy of the church is an expression of the gospel”. Thus began a wonderful journey of showing our faith by our works – in this case the works of investment decision-making.

This was a profound decision. Many fund managers around the world are only now starting to discover the importance of making investment decisions that are aware of the environmental and social impact of the activities they’re funding. However, the Uniting Church can proudly say that this has been “in our DNA” for over 4 decades already! We were a world leader, and I’m very pleased to be the current baton carrier in our Synod for these principles.

The guidelines that the 1980 report proposed have been tweaked a bit over the years, but they are essentially the same today as they were then.

Including one that’s been on my mind a bit recently. Throughout history, the people of God have had a particular concern for the poor. Our ethical investment principles capture that concern in a requirement that we don’t encourage or profit from activities which “entice the poor into financial over-commitment”. I think that this is a good, modern way of talking about the Old Testament prohibition on the charging of ‘usury’.

In brief, in the book of Exodus, among a raft of laws about property and social responsibility, is this: “If you lend money to one of my people among you who is needy, do not treat it like a business deal; charge no interest.” (Ex 22:25 NIV)

This wasn’t a ban on ever charging interest on a loan – business transactions were done with foreigners (Deuteronomy 23:20) – but a recognition that usually a fellow Israelite would only need to borrow money because their crop had failed and they needed to feed their families.

To profit from someone in such a situation was wrong, and it still is. The main way that we implement this principle is that put onto the excluded investment list – that is, we won’t own shares in them – companies that colloquially we call ‘payday lenders’. Payday loans are high cost, short-term loans that people typically take out to cover a cash short-fall when they need to pay a bill. You’ve all seen their ads on television, with colourful characters jumping into the living room with a wallet full of money to rescue you.

The reality is that it all too often becomes a trap. And it’s a trap that Australians are increasingly falling into. Often the dollar amounts don’t sound too large – someone needs $200 to make a payment urgently – but a payday loan can within a couple of weeks turn into an obligation to repay $350 or more, requiring another loan and the beginning of a devastating cycle. Or someone needs to replace an important item, such as a fridge, so they buy one on finance that looks cheap, but is punitive when all the fees are taken into account and the penalties for late payment are added on. It’s really profitable for the lender, but makes the borrowers’ situation worse.

However, it’s one thing for us to refuse to profit from this activity, but quite another to be able to help those who might be caught in the trap. What can we do that’s positive to help deal with the problem?

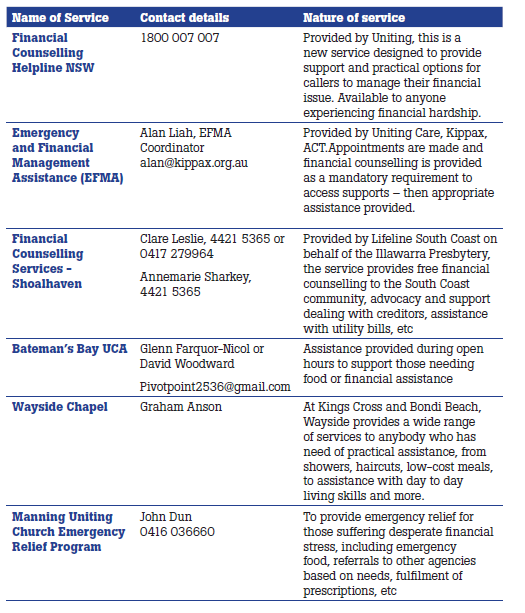

Recently we at UFS have been working with other arms of the Church – Uniting, some parish Missions, Wayside Chapel and UME – to identify and co-ordinate the services that are already available to help people in straitened financial circumstances. In turn, we hope to identify more that can be done as a service to the community. Our first cut of a list of services is, including the Government’s Money Smart service and the non-denominational Christians Against Poverty.

If you or someone you know is in a position that might lead you to a payday lender, please don’t go there; please advise your friend not to go there. You don’t have to walk into the trap. There are better ways and if you contact one of the groups on the list you can get help.

Or if you or someone you know is in the trap, reach out urgently. Some of the services listed can help you to rearrange your finances and get your lives back in order.

The purpose of the Old Testament law I quoted earlier was to enable the needy person to live in the community with purpose and dignity. That’s our goal as well.

The following table lists some of the services we’ve been able to identify within the Uniting Church that are designed to help people in financial straits who might otherwise be lured into the downward spiral of payday loans. We don’t pretend this is comprehensive, but hopefully it will help you to support those you know require such assistance. We’d love to hear from you if you know of others.

In addition, Christians Against Poverty is an international organisation which operates in Australia. It provides debt restructuring assistance and advocacy, counselling and courses in budgeting and financial management. The service is free and open to all – you don’t have to be Christian.

The Australian Securities and Investments Commission (ASIC) has an informative website that discusses payday lending and how to avoid the trap.

Warren Bird is Executive Director of Uniting Financial Services

2 thoughts on “Pay day lending…don’t get cleaned out”

Thanks for spreading awareness about this issue! I work for Christians Against Poverty (CAP) and know that we do great work and help many people who have struggled with re-paying Payday loans.

If you or someonw you know needs debt help please call us on: 1300 227 000

Good to read that ASIC (the Australian Securities and Investment Commission, one of UFS’s regulatory bodies) is taking action against a couple of the worst examples of payday lending. They’ve been given new powers by the Federal Government to intervene.

https://www.afr.com/business/banking-and-finance/asic-targets-payday-lenders-charging-1000-percent-interest-20190709-p525hk